Tropykus finance.

Decentralized finance for Latam needs.

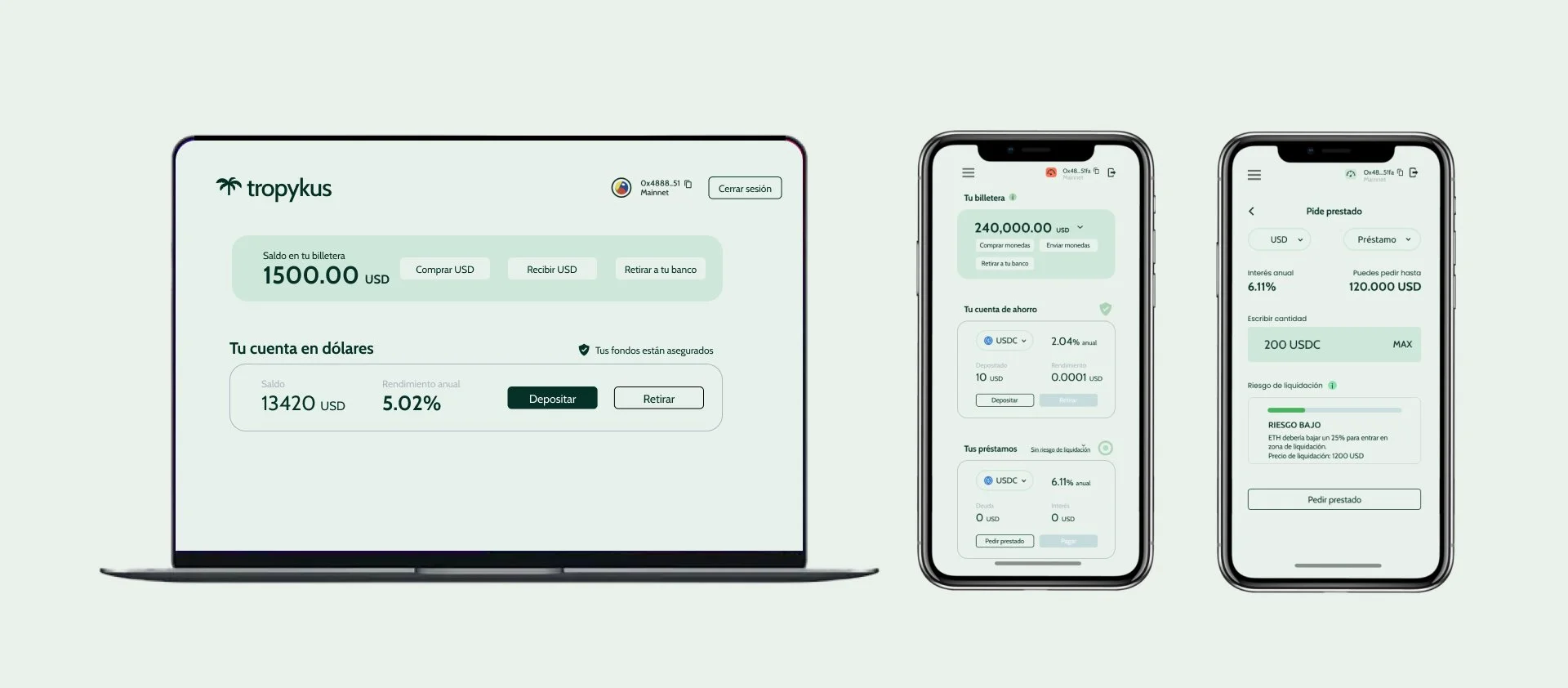

Our challenge as cofounders was to build from scratch a product to help Latinamericans save in a strong currency (USD) to escape from local currency devaluation and avoid predatory interest rates in loans (+40% annually). With our previous knowledge in blockchain, we realized that the benefits of Decentralized finance were a perfect fit to build our product.

The mission of Tropykus is to offer better saving options and fairer loans than local banks around Latam. It was launched publicly on 1st February of 2022 and as today it had more than 9.1 million USD deposited in the platform and 2.6 million USD borrowed, reaching a company valuation of 3.25M USD.

My role

I am cofounder of Tropykus and head of the Product team (Product management, Product design and UX research) for the last 4 years. One of my biggest responsibilities is to align the development team, product team and marketing team. Define common KPIs to achieve our north star metric, prioritize user needs, measure experiments and share learnings with the team to set next steps.

Since Tropykus is an early stage startup, during this time our main goal was to find Product Market Fit. This goal required to iterate our value proposition at the same time we found specific user needs and new use cases from our community, and improve iteratively our product on the go.

Building process

In 2021 we decided to build Tropykus on Bitcoin layer 2 to add the functionality of smart contracts from Ethereum Virtual Machine, so we built on top of Rootstock blockchain, which had the smallest gas fees in the markets, the perfect fit for our Latam users.

Our product started with the desktop version and the goal was to build the simplest user experience possible reducing crypto terms and explain complex concepts graphically (liquidation, collateral factor…)

There were many barriers: Access to buy Bitcoin in layer 2 and to buy stablecoins with local currencies around Latam in the DeFi ecosystem, pay the gas, crypto wallets…

So we had to work really hard to integrate new services and add Polygon blockchain to enhance our experience: Email Web3 login, subsidy of gas with account abstraction, on-off ramps in different countries, P2P partners, bridges…

After many experiments and several deployed new versions, we had new users that had no previous knowledge on crypto, which validated our initial hypothesis to reach mainstream adoption. This learning process to improve the product is continuous and currently our community is supporting us to shape new features and complementary services for Tropykus.

You can use Tropykus here > www.tropykus.com

We are proud that Tropykus was featured in media such Forbes, Cointelegraph and Beincrypto among many others.

The product is providing financial value with real use cases in Latam:

" Tropykus is the best option that I have to get a loan in fair conditions. I am the owner of a bakery, and this is helping me to manage my debt in a flexible manner and I was able to buy new equipment to increase my daily production"

Ricardo, Argentinian user of Tropykus

Results

As January 2025, the current results of the project are very promising:

9M USD in deposits (Bitcoin and stablecoins) generating an average annual yield of 6% for Latinamerican users.

2.6M USD borrowed in loans historically at an average of 10% APY, much lower than any local bank in different countries in Latam (Colombia, Argentina, Venezuela…)

Last year TVL growth: 1450%

The TVL grew more than 15x.

From 314k USD (Jan 2023) to 4.82M USD (March 2024)

Lessons learnt

During these years building Tropykus my learnings are endless from a professional and personal point of view, therefore I will try to summarize the most relevant ones regarding Product, Web3 and startup leadership:

- Finding early users who help you to shape the first versions of the product makes the difference.

- To be competitive in the market, your product must be 10x better than the other products out there. Otherwise, focus on building your competitive advantage.

- Addressing a specific problem of the user is key to find PMF. The bigger the pain is, more options for your product to be successful. Get obsessed to solve this problem for them.

- Launch simple experiments with clear hypothesis and measure it properly.

It is not easy but it will help your product to evolve as fast as possible.

- Crypto and Web3 are promising technologies but the gap between tech and product in this ecosystem is still big. You can’t ask your users to learn about crypto, crypto products should adjust to non crypto users. Users value the benefits of the product, not the technology itself. If you build in DeFi, better think that you are building a Fintech product.

And many more… :)